- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

How To Search Texas Business Entities

- Uncover In-Depth Information on Business Entities

- How To Find the Owner of a Business Entity in Texas?

- Why Conduct a Texas Entity Search?

- Who Holds Data for Texas Business Entity Search?

- What Entities Can You Register in Texas?

- How Do I Check If a Business Entity Name is Taken in Texas?

- How Do I Set Up a Business Entity in Texas?

- How Much Does It Cost To Start a Business In Texas?

- Additional Information Available on the Texas Secretary of the Commonwealth's Website

- FAQs About Business Entity Searches in Texas

Anyone looking to search for Texas businesses may use the resources available on the Secretary of State's website or the Texas Comptroller’s website. On the Texas Secretary of State website, searches are typically completed using the SOSDirect Online Searches and Filings tool. However, the tool typically requires users to have an account on the system before they may use all the features of the tool.

On the other hand, the Franchise Tax Account Status Search tool on the Texas Comptroller of Public Accounts website is free for use for the public without needing the creation of an account on the system.

Choose Your Search Criteria

- Tax ID:

Enter the 11-digit Comptroller's Taxpayer Number or 9-digit FEIN.

- Entity Name:

Use the business name registered with the state.

- File Number:

Enter the unique number assigned by the Secretary of State.

Review Search Results

To perform a business entity search, provide the entity's tax ID, name, or file number in the appropriate search field. After clicking the 'Search' button, the system will return a list of matching results, including the business name, taxpayer ID number, and zip code.

Further Assistance

If further assistance is required in finding a Texas business entity, contact the Texas Secretary of State at:

Mailing Address:

Business & Commercial Section

Secretary of State

P.O. Box 13697

Austin, TX 78711-3697

Delivery Address:

1019 Brazos St.

Austin, TX 78701

Phone: (512) 463-5555

How To Find the Owner of a Business Entity in Texas?

Finding the owner of a business entity in Texas may be straightforward in some instances where such information is available on the website of the entity. Also, if the registered agent of a business is the owner of the website, a search on the Texas Comptroller of Public Accounts website will reveal the identity of the entity’s owner.

Other resources or sources through which you may find the owner of a business entity in Texas include:

- Local Chambers of Commerce

Local chambers of commerce are good sources for finding business owners in Texas as they maintain directories of member businesses, often including details about the owners or key contacts.

- Better Business Bureau (BBB)

The Better Business Bureau in Texas provides verified information on businesses, which sometimes includes the names of business owners or principals. In addition, BBB reports often include contact details of local businesses for further inquiries.

Why Conduct a Texas Entity Search?

By verifying the business name, registration status, and operational details, customers can confirm they are dealing with a legitimate entity. This may be especially important when engaging with new service providers, purchasing expensive products, or entering into agreements where the business's reputation matters.

Investors use business entity searches to evaluate potential investment opportunities. Key information such as the business’s structure, legal standing, and historical filings may indicate its stability and compliance with regulations. Hence, this search may help investors avoid potential scams.

Businesses may use a business entity search to get assurance on the legitimacy and reliability of a potential supplier. If a supplier business is registered with the state, you may use the business search tool to reduce risks of unfulfilled obligations by performing an entity search.

Business entity searches act as a safeguard against fraud by confirming the validity of a company’s existence and operations. This may help identify potential scams or illegitimate operations, protecting consumers and other businesses from fraudulent entities.

Who Holds Data for Texas Business Entity Search?

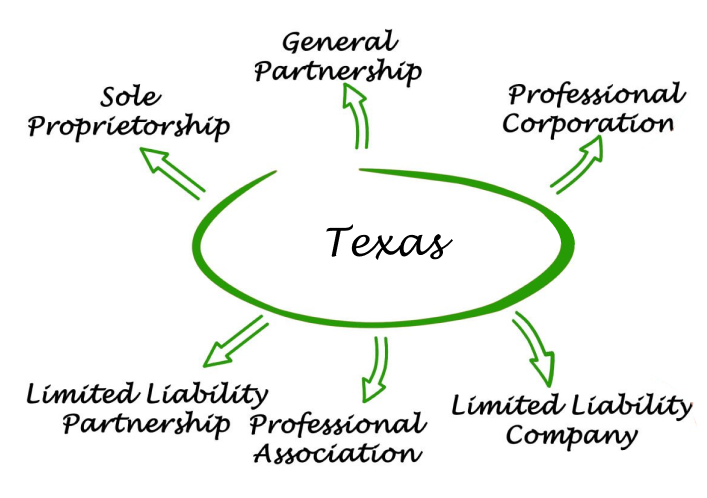

What Entities Can You Register in Texas?

Generally, businesses are operated in the following entity formations in Texas:

A sole proprietorship is the simplest form of business formation in Texas as it requires no formal organization. In this business formation type, a single individual owns the business and makes decisions for the business. The profit in the business belongs to the sole proprietor, while the individual is also liable for all debts and obligations of the business.

A general partnership involves two or more individuals conducting a business for profit. While no formal agreement or state filing is required, partnerships using an assumed name must file a DBA with the county clerk in relevant counties.

A Texas corporation is established by filing a certificate of formation with the Texas Secretary of State. This legal entity has characteristics such as limited liability and centralized management. Owners, called shareholders, may manage directly through agreements or appoint directors. For-profit corporations may elect "S" corporation tax status with the IRS.

A public benefit corporation is a domestic, for-profit corporation designed to create a public benefit while operating responsibly and sustainably. Under HB 3488, a for-profit corporation may elect to become a public benefit corporation.

An LLC combines elements of corporations and partnerships, providing liability protection and tax flexibility. It is formed by filing a certificate of formation with the Texas Secretary of State. Owners, known as members, may be individuals or entities, and the LLC's management structure must be specified.

A Series LLC in Texas is a specialized type of limited liability company that allows for the creation of multiple distinct "series" within a single LLC. Each series can have separate members, managers, assets, liabilities, and purposes, different from the overarching LLC and other series. These individual series may independently conduct business, enter contracts, own assets, and manage liabilities. An LLC may establish a protected or registered series.

An LP has general partners managing the business and limited partners with liability restricted to their investment. A certificate of formation must be filed with the Texas Secretary of State.

General or limited partnerships may register as an LLP to limit general partners’ liability. Registration requires filing with the Texas Secretary of State.

A Texas DBA (also called Doing Business As name) is an assumed name that a business chooses to operate under that is not its legally registered business name.

How Do I Check If a Business Entity Name Is Taken in Texas?

How Do I Set up A Business Entity in Texas?

- Write a business plan.

- Choose your business location and structure.

- Register your business name and appoint a registered agent.

- Register for state and federal taxes.

- Determine license and permit requirements.

- Understand employer requirements if hiring staff.

How Much Does It Cost to Start a Business in Texas?

Startup costs in Texas vary by entity type and business needs. Key expenses include:

- Filing Fees

LLC: $300, Corporation: $300, Partnership: $750, DBA: $25.

- Registered Agent Services

$50–$300 annually depending on provider.

- Licensing & Permits

$50 to several hundred depending on business type.

- Insurance & Zoning

General liability insurance: $500–$2,000/year.

Additional Information Available on the Texas Secretary of State’s Website

- Certificate of Filing Verification

Verify your Texas business registration.

- Business Opportunity & Credit Searches

Look up various registration details online.

- Filing Status & UCC Tracker

Track business and UCC filings online.

- Notary & Apostilles

Resources for document authentication in Texas.

FAQs about Business Entity Searches in Texas

- Why would I need to search for a business entity in Texas?

To verify a business's legal and operational status.

- What types of entities can I search for in Texas?

Sole proprietorships, LLCs, corporations, DBAs, and more.

- Where can I perform a business entity search in Texas?

Use SOSDirect or Texas Comptroller’s tool.

- What information do I need to conduct an entity search in Texas?

Business name, tax ID number, or filing number.

- How do I find the official name of a Texas business?

Use tax ID or filing number on the Comptroller’s search tool.

- Can I search for foreign entities in Texas?

Yes, via the Comptroller’s business search tool.

- What information can I find in the Texas entity search?

Tax ID, formation state, SOS status, agent info, and more.

- How do I verify if a Texas business is in good standing?

Check the 'registration status' field in search results.

- Can I search for an entity in Texas by its owner’s name?

No. These tools do not support owner-based searches.

- How often is the Texas business entity database updated?

Databases are updated daily.

- Can I obtain copies of business filings in Texas?

Yes. Request copies via the Secretary of State’s office.

- How do I find out who the registered agent of a Texas business is?

Agent details are shown in Comptroller search results.

- How can I search for Texas businesses by their tax ID number?

Use the Comptroller tool with an 11-digit taxpayer number or 9-digit EIN.

- What should I do if I can’t find a business entity in the Texas search?

Double-check input, consult the county clerk, or contact the SOS.

- Uncover In-Depth Information on Business Entities

- How To Find the Owner of a Business Entity in Texas?

- Why Conduct a Texas Entity Search?

- Who Holds Data for Texas Business Entity Search?

- What Entities Can You Register in Texas?

- How Do I Check If a Business Entity Name is Taken in Texas?

- How Do I Set Up a Business Entity in Texas?

- How Much Does It Cost To Start a Business In Texas?

- Additional Information Available on the Texas Secretary of the Commonwealth's Website

- FAQs About Business Entity Searches in Texas